Content

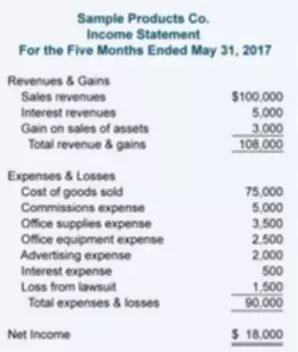

Net income increases Retained Earnings, while net losses and dividends decrease Retained Earnings in any given year. Thus, the balance in Retained Earnings represents the corporation’s accumulated net income not distributed to stockholders. Once reported on the balance sheet, retained earnings become a part of a business’s total book value. We can find the dividends paid to shareholders in the financing section of the company’s statement of cash flows. Understanding how retained earnings relate to financial statements is essential for investors who want to evaluate a company’s profitability and future potential growth opportunities. If a company has negative retained earnings, it has accumulated deficit, which means a company has more debt than earned profits.

Here, we’ll focus on what negative retained earnings mean and what they indicate for the success of your business. The main difference between retained earnings and profits is that retained earnings subtract dividend payments from a company’s profit, whereas profits do not. Where profits may indicate that a company has positive net income, retained earnings may show that a company has a net loss depending on the amount of dividends it paid out to shareholders. On the other hand, though negative retained earnings stock dividends do not lead to a cash outflow, the stock payment transfers part of the retained earnings to common stock. For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by announcing a stock dividend, the per-share market price is adjusted according to the proportion of the stock dividend.

The Purpose of Retained Earnings

For this reason, retained earnings decrease when a company either loses money or pays dividends and increase when new profits are created. Anyone looking to invest in your company or loan your company money will want to know why you have an accumulated deficit. If you’re a struggling startup, it might be understandable that you ran into trouble. It’s more alarming when an established company that’s had years to accumulate earnings shows a retained earnings deficit.

What is a negative retained earnings called?

RE = BP + Net Income or Net Loss – C− S

That figure is called negative retained earnings. Sometimes called retained losses, accumulated deficit, or accumulated losses.

While paying dividends to shareholders is one way to use profits, aiming for higher retained earnings can be a more effective long-term strategy for creating shareholder value. Therefore, a company’s retained earnings, revenue, and net income are all good indicators of its financial health. Just like with any financial metric, retained earnings should not be considered in isolation. For example, an acceptable range of values will depend not only on the industry and business model but also on the company’s current maturity or status.

What Do Negative Retained Earnings Mean?

Many investors find it confusing that companies can pay a dividend, even when losing money. Look at Starbucks’ balance sheet to understand how negative retained earnings could affect the company. Let’s look at a real company’s financials to get an idea of how to find negative retained earnings. Negative retained earnings would result from a negative net income and then be subtracted from any balance in retained earnings from prior financial reports, i.e., 10-Q or 10-K.

- Looking at some of their early annual reports, you will see negative retained earnings through the early years.

- Retained earnings are the money that rolls over into every new accounting period.

- She has worked in multiple cities covering breaking news, politics, education, and more.

- Also, note that negative retained earnings do not necessarily mean that the shareholders have to give money to the company.

- Larry is also a Florida Supreme Court Certified Mediator and a qualified arbitrator with over 25 years of ADR experience.

Shareholder’s equity is simply the difference between Assets and Liabilities. Your company’s retention rate is the percentage of profits reinvested into the business. Multiplying that number by your company’s net income will give you the retained earnings balance for the period. A company’s retained earnings statement begins with the company’s beginning equity. This number is found on the company’s balance sheet and tells you how much money the company started with at the beginning of the period.

The Importance of Retained Earnings

In financial modeling, it’s necessary to have a separate schedule for modeling retained earnings. The schedule uses a corkscrew type calculation, where the current period opening balance is equal to the prior period closing balance. In between the opening and closing balances, the current period net income/loss is added and any dividends are deducted. Finally, the closing balance of the schedule links to the balance sheet. This helps complete the process of linking the 3 financial statements in Excel. Profits give a lot of room to the business owner(s) or the company management to use the surplus money earned.

It is calculated over a period of time (usually a couple of years) and assesses the change in stock price against the net earnings retained by the company. Retained earnings are the cumulative net earnings or profits of a company after https://www.bookstime.com/articles/debt-to-asset-ratio accounting for dividend payments. As an important concept in accounting, the word “retained” captures the fact that because those earnings were not paid out to shareholders as dividends, they were instead retained by the company.

Year-End Bookkeeping and Accounting Checklist for Small Business Owners

By knowing how much profit has been kept over time and what factors contribute to those numbers changing, investors can make more informed decisions about where to put their money. Additionally, companies can use this information when making strategic choices regarding future investments or dividend payments. Retained Earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate RE, the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted. A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period.

- Overall, Coca-Cola’s positive growth in retained earnings despite a sizeable distribution in dividends suggests that the company has a healthy income-generating business model.

- Unlike net income, which can be influenced by various factors and may fluctuate significantly between periods, retained earnings offer a more consistent and reliable indicator of the business’s financial health.

- Accurate calculations can help the company make informed business decisions and ensure that profits get reinvested to benefit the company.

Typically, your retained earnings are kept in a ledger account until the funds are used to reinvest in the company or to pay out future dividends. By calculating retained earnings, companies can get a snapshot of their financial health and make decisions accordingly. You can find this number by subtracting your company’s total expenses from its total revenue for the period. It tells you how much profit the company has made or lost within the established date range. Some companies use their retained earnings to repurchase shares of stock from shareholders. You might go this route for various reasons, such as increasing existing shareholders’ ownership stake or reducing the number of outstanding shares.

When a dividend is declared and paid, retained earnings are reduced by the amount of the dividend. Any changes or movements with net income will directly impact the RE balance. Factors such as an increase or decrease in net income and incurrence of net loss will pave the way to either business profitability or deficit.

What happens when retained earnings are negative?

Negative retained earnings can impact a business's ability to pay dividends to shareholders. If negative retained earnings aren't corrected, it can reduce company equity. Over time, negative retained earnings can put a business at risk for bankruptcy.

Many clients think of Larry as their outside “in house” counsel and a valued member of their team. Larry is also a Florida Supreme Court Certified Mediator and a qualified arbitrator with over 25 years of ADR experience. As consumer demands increase, a business’s financial obligations also rise.